Appearance

Economic Model

The New Tokenomics Model

Our updated tokenomics model prioritizes sustainability, decentralization, and ecosystem development. The changes are designed to maintain a fair distribution, incentivize long-term participation, and ensure that IOST's economic framework supports ongoing innovation and community-driven growth.

Token Allocation

The current supply of IOST tokens will be strategically adjusted to ensure both fairness and the robust participation of all ecosystem stakeholders:

| Category | Allocation |

|---|---|

| Existing Circulating Supply | ~21.32B $IOST |

| New Allocation for Growth | 21.32B $IOST |

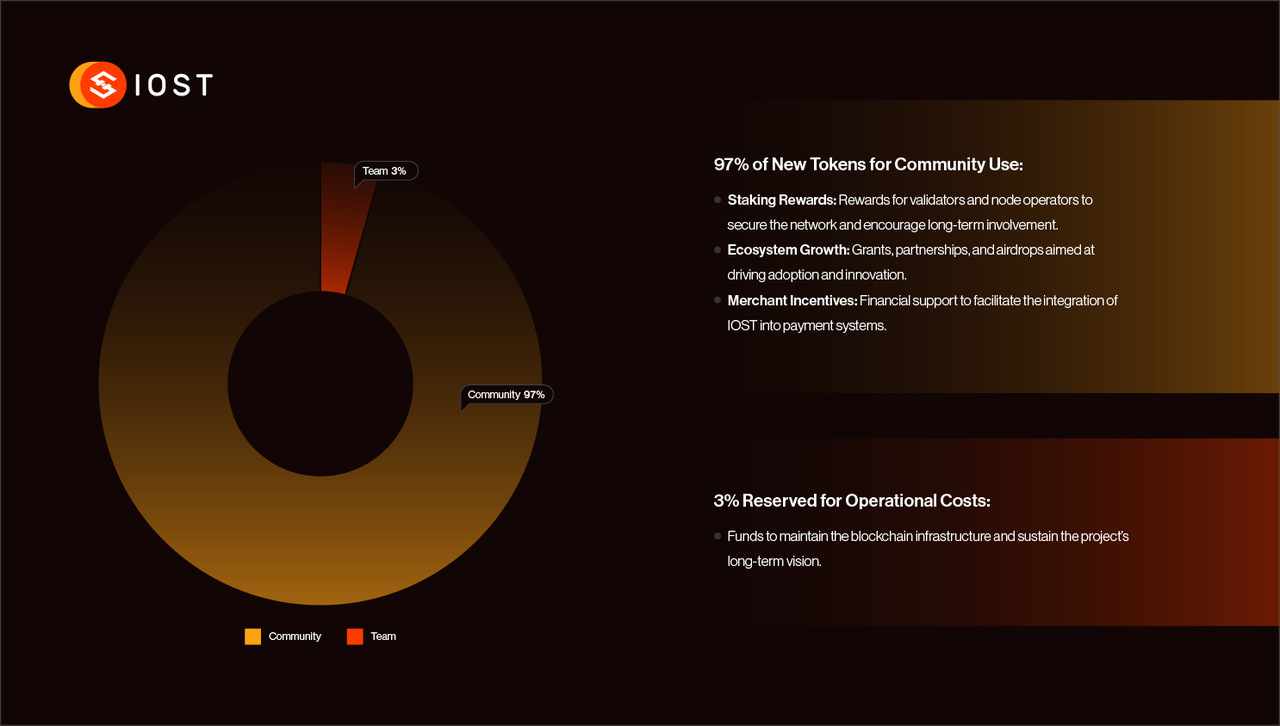

97% of Newly Issued Tokens for Community Use:

- Staking Rewards: Incentivizing validators and node operators to secure the network and foster long-term engagement.

- Ecosystem Growth: Grants, partnerships, and airdrops aimed at driving adoption, technical advancement, and broad ecosystem development.

- Merchant Incentives: Financial support for integrating IOST into payment systems, encouraging real-world use cases and further expansion.

3% Reserved for Operational Costs & Recruiting:

- Funds dedicated to maintaining infrastructure and sustaining the project's long-term vision, ensuring that the core network remains robust, efficient, and secure.

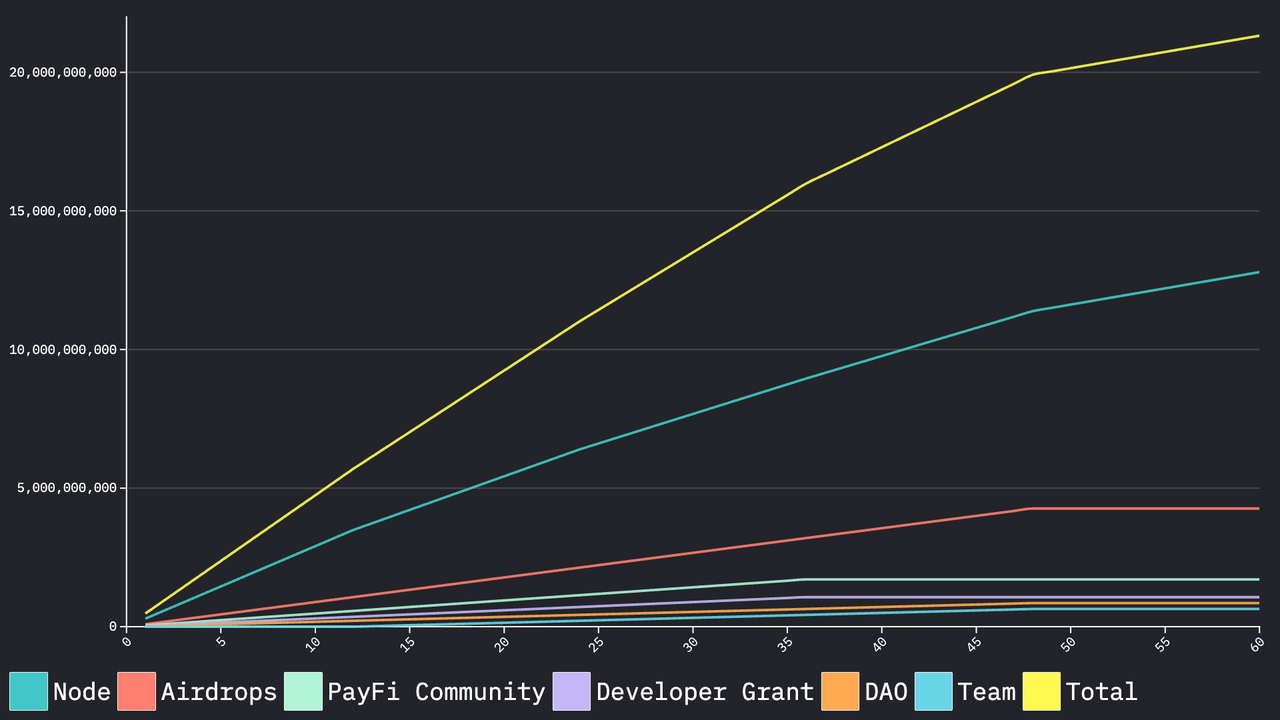

Breakdown of the Newly Issued Tokens

| Purpose | Allocation | Vesting Schedule |

|---|---|---|

| PayPIN Node Rewards | 60% | Released over 60 months |

| Airdrops & Stakedrops | 20% | Released over 48 months |

| PayFi Community Incentives | 8% | Released over 36 months |

| Developer Grants | 5% | Released over 36 months |

| Nexus DAO Funds | 4% | Released over 48 months |

| Team Incentives | 3% | 12-month lock, 36-month release |

Detailed Allocations

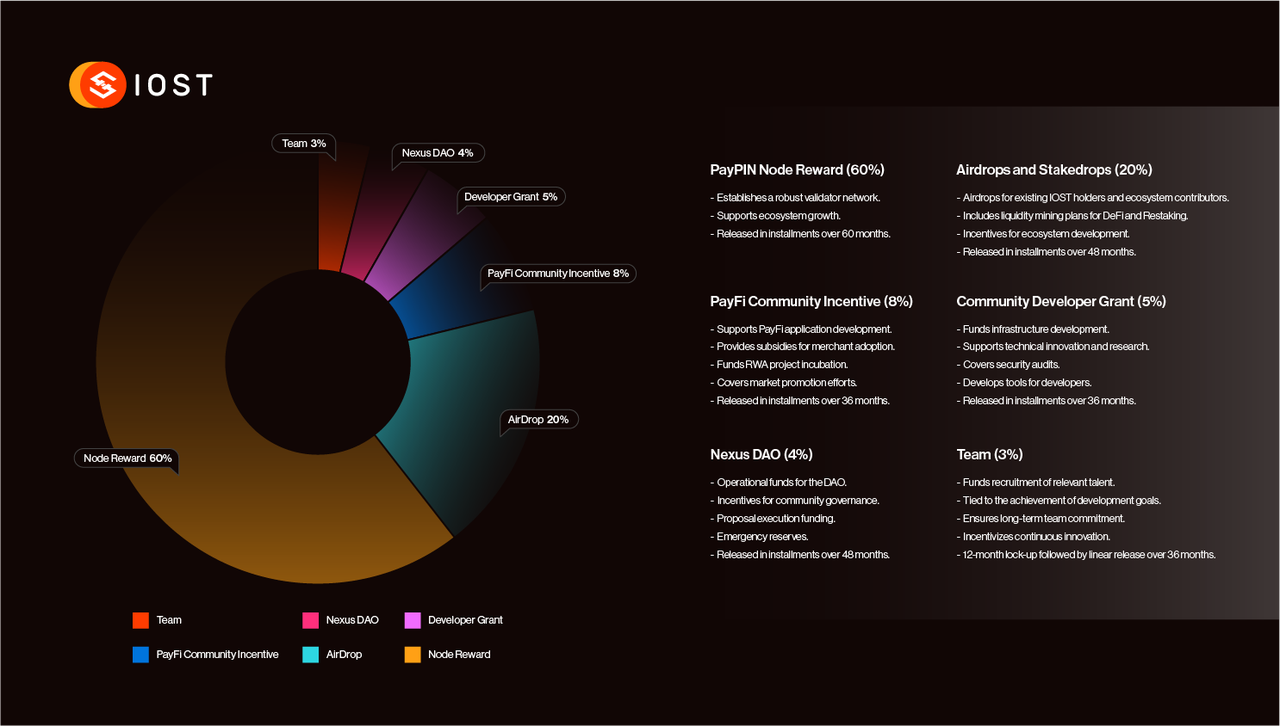

PayPIN Node Reward (60%)

- Establishes a robust validator network

- Supports ecosystem growth

- Released in installments over 60 months

Airdrops and Stakedrops (20%)

- Airdrops for existing IOST holders and ecosystem contributors

- Includes liquidity mining plans

- Incentives for ecosystem development

- Released in installments over 48 months

PayFi Community Incentive (8%)

- Supports PayFi application development

- Provides subsidies for merchant adoption

- Incubation funds for RWA, DePIN, and Payment projects

- Covers market promotion efforts

- Released in installments over 36 months

Community Developer Grant (5%)

- Funds infrastructure development

- Supports technical innovation and research

- Covers security audits

- Developer tools

- Released in installments over 36 months

Nexus DAO (4%)

- Operational funds for the DAO

- Incentives for community governance

- Proposal execution funding

- Emergency reserves

- Released in installments over 48 months

Team (3%)

- Funds recruitment of relevant talent

- Tied to the achievement of development goals

- Ensures long-term team commitment

- Incentivizes continuous innovation

- 12-month lock-up followed by linear release over 36 months

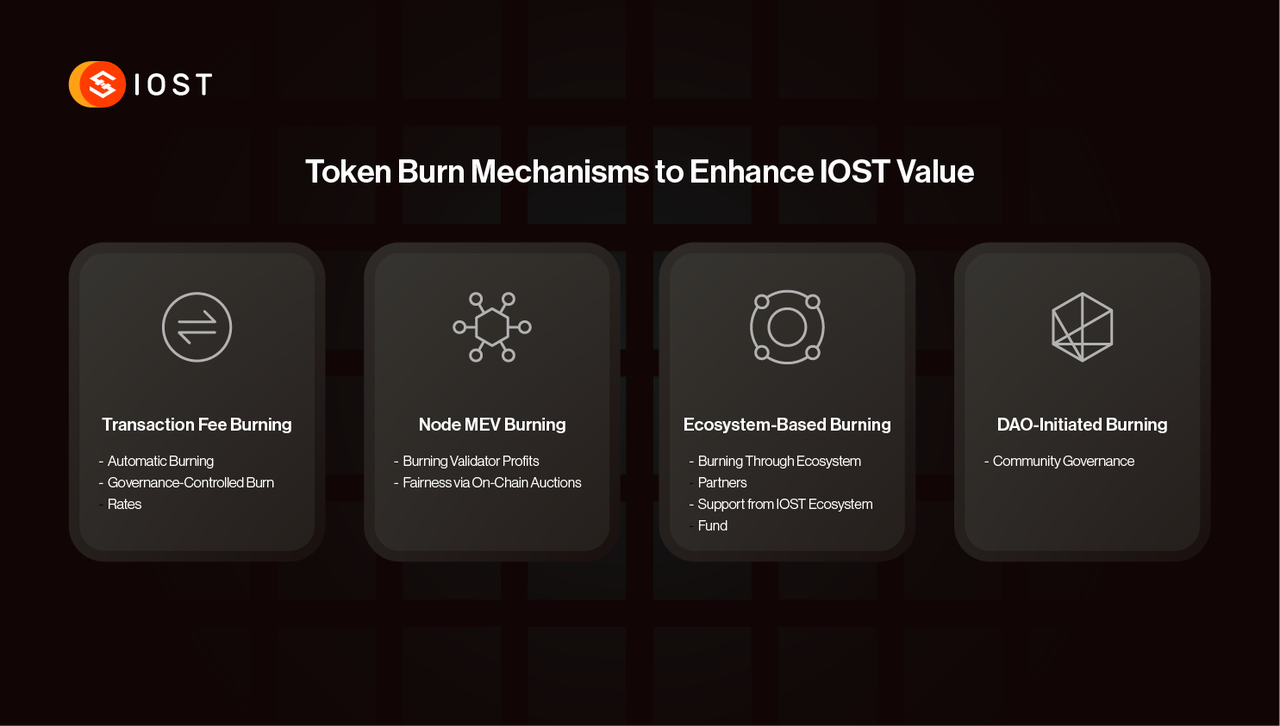

Token Burn Mechanisms to Enhance IOST Value

To maintain a healthy economic balance and introduce a deflationary element, we've implemented four interconnected token burn mechanisms:

1. Transaction Fee Burning

- Six months after the launch of IOST L2, gas fees will be denominated in IOST

- A portion of these fees will be automatically burned

- On-chain governance will adjust burn rates to ensure equitable incentives and overall network health

2. Node MEV Burning

- A portion of validator profits from MEV will be burned

- On-chain auctions will ensure fairness and discourage unethical practices

3. Ecosystem-Based Burning

- Ecosystem partners integrate burn mechanisms into their business models

- The IOST Ecosystem Fund supports partners in adopting these features, reducing token supply as the ecosystem matures

4. DAO-Initiated Burning

- Community-driven proposals and votes will determine additional burn events

- Decentralized governance ensures that the community maintains collective stewardship over the token's long-term value

- Voting is conducted quarterly

Token Burn Impact Analysis

The combination of our four burn mechanisms is expected to create significant deflationary pressure as network adoption grows. Based on our projected metrics and market analysis:

1. Transaction Fee Burning

- Projected daily transactions by end of 2025: 12M/day

- Estimated average transaction fee: $0.0025

- Burn rate: 20% of transaction fees

- Annual burn impact: $2.19M

2. MEV Burning

- Estimated MEV value: 1% of total transaction volume

- Projected monthly volume by Q4 2025: $200M

- MEV burn rate: 30% of extracted value

- Annual burn impact: $1.8M

3. Ecosystem-Based Burning

- Target RWA tokenization: >$0.5B by Phase 2

- Average fee rate: 0.1% for RWA transactions

- Average tx per year per token: 10 times

- Burn rate: 15% of fees

- Annual burn impact: ~$1M

4. DAO-Initiated Burning

- Based on network usage metrics

- Conservative estimate: 0.5% of network fees

- Annual burn impact: ~$3M

| Burning Mechanism | End of 2025 | Estimate whole year |

|---|---|---|

| Transaction Fee Burning | 12M tx/day | $2.19M |

| MEV Burning | $200M monthly volume | $1.8M |

| Ecosystem-Based Burning | $500M RWA Trading volume | ~$1M |

| DAO-Initiated Burning | $3M | $3M |

| Total | $8M |

Total Projected Annual Burn:

- For the end of 2025 scenario using the provided figures, the estimated total annual burn impact is approximately $8 million. This represents a substantial likelihood of deflationary effect that scales with network growth and usage.

The burn mechanisms are designed to become more impactful as network adoption grows, creating a natural balance between ecosystem expansion and token value preservation. For context, these burn rates would offset a significant portion of any new token emissions from the Ecosystem Growth Reserve, helping maintain price stability while supporting network growth.

It's important to note that these are conservative estimates based on our initial targets. As we achieve higher network adoption and transaction volumes, the actual burn impact could be substantially higher. The dynamic nature of these mechanisms ensures that increased network usage automatically leads to increased burning, creating a sustainable economic model that scales with ecosystem growth.

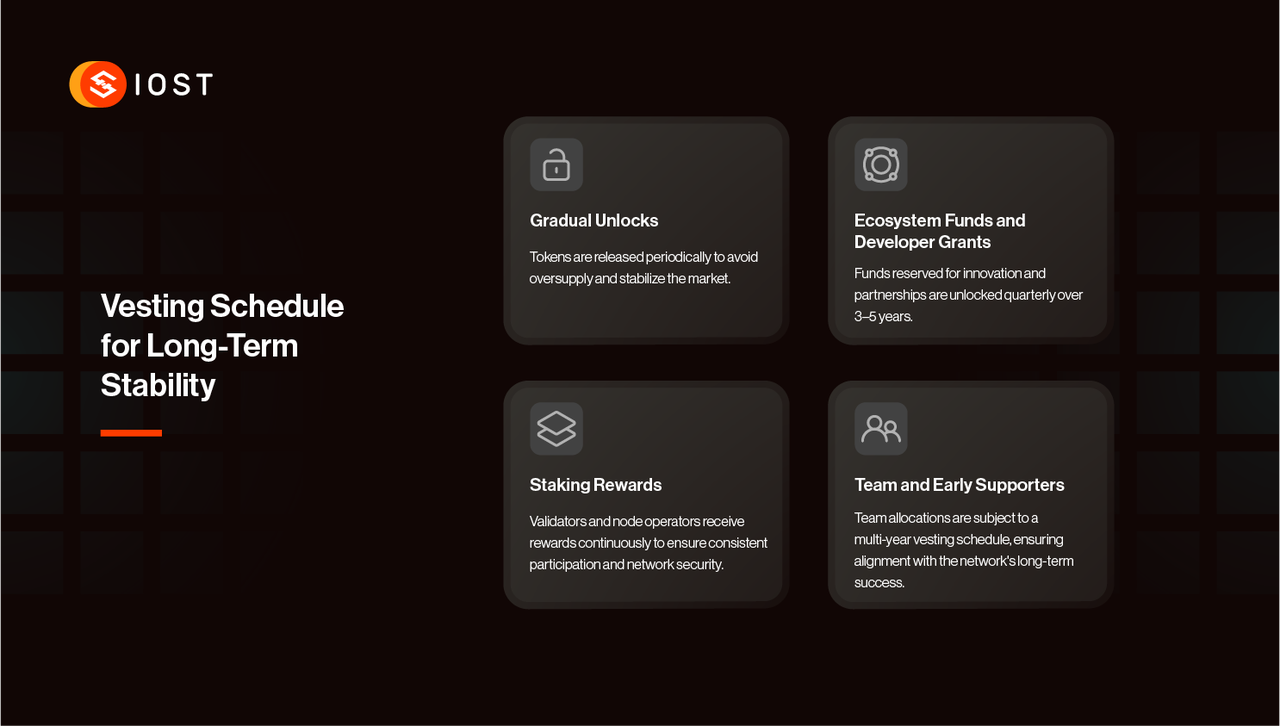

Vesting Schedule for Long-Term Stability

A structured vesting schedule ensures a predictable, gradual release of tokens:

- Gradual Unlocks: Prevent oversupply and stabilize the market over time

- Ecosystem Funds and Developer Grants: Reserved for innovation and partnerships, unlocked quarterly over 3–5 years

- Staking Rewards: Continuous rewards for validators and node operators, ensuring steady network participation and security

- Team and Early Supporters: Multi-year vesting schedules align their interests with the network's long-term success

Detailed Vesting Schedule

Long-Term Impact

Our goal is to build a long-lasting foundation that ensures meaningful, enduring value for all participants in the ecosystem. To achieve this, we're focusing on strategies that go beyond short-term gains, such as:

- Introducing a structured token burn mechanism to preserve long-term value

- Implementing predictable vesting schedules that encourage responsible growth

- Aligning incentives so that every stakeholder—be they developers, users, or investors—benefits as the network matures

By fostering a community-driven and scalable ecosystem supported by sustainable innovation and the principles of decentralized finance, we aim to maintain relevance, adapt to emerging trends, and lead within the broader Web3 environment. In short, every initiative we undertake is guided by the conviction that true, transformative impact unfolds over time.

Looking Ahead: A Growing Ecosystem and A new Species of PayFi + DePin

These adjustments to IOST's tokenomics lay the foundation for a more resilient, community-focused, and value-driven ecosystem. By prioritizing sustainable incentives and deflationary controls, we aim to foster an environment where collective innovation thrives, market confidence grows, and long-term value accumulates naturally.

As we continue to evolve and refine the platform, we are excited to share that a Node Sale is on the horizon. This upcoming initiative will further enhance network participation and opportunity. Stay tuned for more details as we continue building a stronger, more inclusive ecosystem for everyone involved.